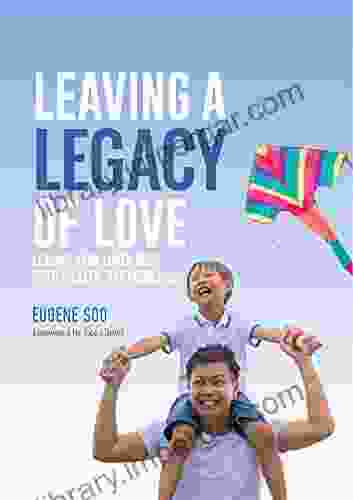

Leaving Your Loved Ones With Wealth, Not Problems: A Comprehensive Guide to Estate Planning

Planning for the distribution of your assets after your passing is a profound act of love and responsibility. By creating a well-structured estate plan, you can ensure your loved ones inherit your wealth without encountering the complexities and financial burdens that often accompany probate.

5 out of 5

| Language | : | English |

| File size | : | 1471 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 136 pages |

| Lending | : | Enabled |

This comprehensive guide, "Leaving Your Loved Ones With Wealth, Not Problems," will empower you with the knowledge and tools necessary to navigate the intricacies of estate planning. From understanding the basics to implementing sophisticated strategies, you will gain a thorough understanding of how to create a legacy that safeguards your family's financial well-being.

Chapter 1: The Importance of Estate Planning

In this chapter, you will explore the profound benefits of estate planning, including:

- Ensuring your wishes are honored: Guarantee that your assets are distributed according to your intentions, regardless of any disputes or unforeseen circumstances.

- Minimizing taxes and probate costs: Protect your estate from unnecessary financial burdens that could erode its value.

- Providing financial security for your loved ones: Leave a legacy of financial stability for your family, securing their future and reducing their stress during a difficult time.

Chapter 2: Understanding Wills and Trusts

This chapter provides a detailed overview of the two primary estate planning tools:

Wills:

- A legal document that outlines your wishes for the distribution of your assets after your death.

- Must be signed and witnessed in accordance with your state's legal requirements.

- Can be amended or revoked at any time during your life.

Trusts:

- A legal arrangement that transfers ownership of your assets to a trustee, who manages them according to your instructions.

- Offers greater flexibility and control over the distribution of your assets, and can provide tax benefits.

- Can be revocable or irrevocable, depending on your circumstances.

Chapter 3: Navigating Probate

Probate refers to the legal process of administering an estate after someone passes away. This chapter explores the complexities of probate, including:

- The role of the executor or administrator

- The process of valuing and distributing assets

- Strategies to minimize probate costs and delays

Chapter 4: Tax Minimization Strategies

Tax minimization is a crucial aspect of estate planning. This chapter delves into various strategies to reduce the tax burden on your estate, including:

- Utilizing trusts to shelter assets from estate taxes

- Taking advantage of tax exemptions and deductions

- Gifting assets to reduce the size of your taxable estate

Chapter 5: End-of-Life Planning

End-of-life planning ensures your wishes are respected and your loved ones are prepared for your passing. This chapter covers:

- Creating healthcare directives, including living wills and do-not-resuscitate Free Downloads

- Establishing power of attorney for healthcare and financial decisions

- Planning for funeral arrangements and burial preferences

Chapter 6: Implementing Your Estate Plan

Once you have crafted your estate plan, it's essential to ensure it is implemented effectively. This chapter guides you through:

- Choosing the right executor or trustee

- Funding your trusts and updating your beneficiaries

- Maintaining and reviewing your estate plan

Estate planning is a transformative act that empowers you to create a legacy of financial security and peace of mind for your loved ones. By gaining a comprehensive understanding of the principles and strategies outlined in this book, you can navigate the complexities of estate planning with confidence and leave a lasting impact on your family's future.

Remember, the journey of estate planning is not a one-time event but an ongoing process that requires regular review and adaptation. Embrace the guidance offered in "Leaving Your Loved Ones With Wealth, Not Problems," and you will be well-equipped to ensure your legacy serves as a beacon of love, security, and financial well-being for generations to come.

5 out of 5

| Language | : | English |

| File size | : | 1471 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 136 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Yasushi InoueFollow ·3.4k

Yasushi InoueFollow ·3.4k Eric NelsonFollow ·14k

Eric NelsonFollow ·14k José SaramagoFollow ·19.1k

José SaramagoFollow ·19.1k Jerome BlairFollow ·10.7k

Jerome BlairFollow ·10.7k Jimmy ButlerFollow ·8.7k

Jimmy ButlerFollow ·8.7k Branson CarterFollow ·4k

Branson CarterFollow ·4k Dwight BellFollow ·19.9k

Dwight BellFollow ·19.9k Samuel BeckettFollow ·4.7k

Samuel BeckettFollow ·4.7k

Don Coleman

Don ColemanIn Search of Ramsden and Car: Unveiling the Unsung Heroes...

Document In the annals of scientific...

Tyler Nelson

Tyler NelsonThe Pyramid Home: A Journey Through Time and Architecture

Enter the Realm...

Lucas Reed

Lucas ReedThe Ultimate Guide to Brutal Chess Tactics for Beginners

Chess is a game of...

Brett Simmons

Brett SimmonsSurviving The Emotional Rollercoaster Of Separation

Every separation is a unique experience,...

Andy Cole

Andy ColeLearning From London's Past For A Sustainable Future

London is one of...

5 out of 5

| Language | : | English |

| File size | : | 1471 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 136 pages |

| Lending | : | Enabled |