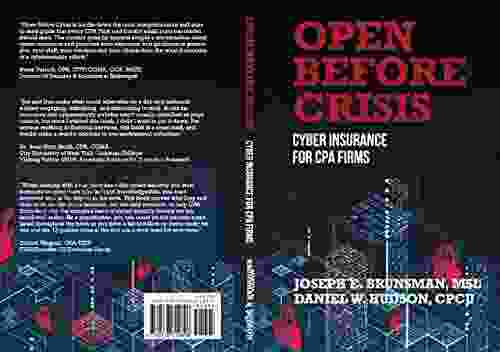

The Definitive Guide to CPA Firm Cyber Insurance

Protect Your Practice from Threats

In today's digital age, CPA firms are increasingly facing the threat of cyber attacks. These attacks can range from phishing scams to ransomware attacks, and they can have a devastating impact on your firm's finances, reputation, and client relationships.

5 out of 5

| Language | : | English |

| File size | : | 5759 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 370 pages |

| Lending | : | Enabled |

Cyber insurance is a critical tool that can help you protect your firm from these threats. This type of insurance can provide coverage for:

* Data breaches * Cyber extortion * Business interruption * Reputation damage

If you're a CPA firm, it's important to understand the basics of cyber insurance and how it can benefit your practice. This guide will provide you with everything you need to know, from the different types of coverage to the factors that affect your premium.

What is CPA Firm Cyber Insurance?

CPA firm cyber insurance is a type of insurance that protects CPA firms from the financial losses associated with cyber attacks. This type of insurance can cover a variety of costs, including:

* The cost of investigating and responding to a data breach * The cost of notifying clients of a data breach * The cost of legal fees associated with a data breach * The cost of business interruption caused by a cyber attack * The cost of reputation damage caused by a cyber attack

Why Do CPA Firms Need Cyber Insurance?

CPA firms are a prime target for cyber attacks because they have access to sensitive financial information. This information can be used by criminals to steal money, commit fraud, or damage your firm's reputation.

In addition, CPA firms are required by law to protect the privacy of their clients' data. If your firm experiences a data breach, you could be held liable for the damages caused to your clients.

Cyber insurance can help you protect your firm from the financial consequences of a cyber attack. This type of insurance can provide you with the peace of mind that you need to focus on your practice without worrying about the threat of cyber attacks.

What Types of Coverage Are Available?

There are a variety of different types of cyber insurance coverage available, so it's important to choose a policy that meets your firm's specific needs. The most common types of coverage include:

* Data breach coverage: This coverage reimburses you for the costs associated with investigating and responding to a data breach. * Cyber extortion coverage: This coverage protects you from the financial losses associated with cyber extortion attacks. * Business interruption coverage: This coverage reimburses you for the loss of income you experience as a result of a cyber attack. * Reputation damage coverage: This coverage reimburses you for the costs associated with repairing your firm's reputation after a cyber attack.

How Much Does Cyber Insurance Cost?

The cost of cyber insurance varies depending on a number of factors, including the size of your firm, the amount of coverage you need, and the deductible you choose. However, you can typically expect to pay between $1,000 and $5,000 per year for cyber insurance.

How to Get Cyber Insurance

If you're interested in getting cyber insurance for your CPA firm, there are a few things you need to do:

1. Assess your firm's cyber risk: The first step is to assess your firm's cyber risk. This will help you determine the types of coverage you need and the amount of coverage you need. 2. Get quotes from multiple insurers: Once you know your risk, you can start getting quotes from multiple insurers. Be sure to compare the coverage, the price, and the deductible of each policy before making a decision. 3. Choose a policy: Once you've compared quotes, you can choose the policy that best meets your firm's needs. Be sure to read the policy carefully before you sign up.

Cyber insurance is a critical tool that can help you protect your CPA firm from the financial losses associated with cyber attacks. By following the steps outlined in this guide, you can get the coverage you need to protect your firm and your clients.

Additional Resources

* [CPA Firm Cyber Insurance](https://www.aicpa.org/content/dam/aicpa/interestareas/business-issues/resources/advisory-services/cybersecurity-risk-management-guide.pdf) * [Cyber Insurance for CPA Firms](https://www.cpajournal.com/2020/09/21/cyber-insurance-for-cpa-firms/) * [The Importance of Cyber Insurance for CPA Firms](https://www.cpapracticeadvisor.com/topics/the-importance-of-cyber-insurance-for-cpa-firms)

5 out of 5

| Language | : | English |

| File size | : | 5759 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 370 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Aleksandr PushkinHistory, Jewish Culture, and Contexts: Unraveling a Tapestry of Tradition,...

Aleksandr PushkinHistory, Jewish Culture, and Contexts: Unraveling a Tapestry of Tradition,...

Arthur C. ClarkeThe Ultimate Power Tools Guide: Your Essential Guide to Power Tools for Every...

Arthur C. ClarkeThe Ultimate Power Tools Guide: Your Essential Guide to Power Tools for Every... Raymond ParkerFollow ·5.6k

Raymond ParkerFollow ·5.6k Jim CoxFollow ·5.9k

Jim CoxFollow ·5.9k Everett BellFollow ·9k

Everett BellFollow ·9k Ira CoxFollow ·9k

Ira CoxFollow ·9k Jacob HayesFollow ·3.1k

Jacob HayesFollow ·3.1k Geoffrey BlairFollow ·16.4k

Geoffrey BlairFollow ·16.4k Frank MitchellFollow ·6.5k

Frank MitchellFollow ·6.5k Gabriel Garcia MarquezFollow ·13.1k

Gabriel Garcia MarquezFollow ·13.1k

Don Coleman

Don ColemanIn Search of Ramsden and Car: Unveiling the Unsung Heroes...

Document In the annals of scientific...

Tyler Nelson

Tyler NelsonThe Pyramid Home: A Journey Through Time and Architecture

Enter the Realm...

Lucas Reed

Lucas ReedThe Ultimate Guide to Brutal Chess Tactics for Beginners

Chess is a game of...

Brett Simmons

Brett SimmonsSurviving The Emotional Rollercoaster Of Separation

Every separation is a unique experience,...

Andy Cole

Andy ColeLearning From London's Past For A Sustainable Future

London is one of...

5 out of 5

| Language | : | English |

| File size | : | 5759 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 370 pages |

| Lending | : | Enabled |