Price Forecasting Models For Strongbridge Bio Ord SBBP Stock: A Comprehensive Guide

In today's volatile stock market, it's more important than ever to have the right tools and knowledge to make informed investment decisions. For investors interested in Strongbridge Bio Ord SBBP stock, understanding how to forecast future prices is key to maximizing returns and minimizing risk.

This comprehensive guide will delve into the world of price forecasting models, specifically tailored to Strongbridge Bio Ord SBBP stock. We'll explore various methodologies, including technical analysis, fundamental analysis, and predictive modeling. By the end of this article, you will have a solid foundation in price forecasting and be well-equipped to develop your own strategies for predicting future stock movements.

Technical Analysis

Technical analysis is a popular approach to price forecasting that involves studying historical price data to identify patterns and trends. The assumption behind technical analysis is that past price movements can provide valuable insights into future behavior.

There are numerous technical indicators and oscillators that traders use to analyze price charts, such as moving averages, support and resistance levels, and relative strength index (RSI). These tools help identify potential trading opportunities and provide early warnings of potential reversals.

While technical analysis can be a valuable tool, it's important to note that it is not an exact science. Price patterns can change over time, and there is no guarantee that past performance will predict future results.

Fundamental Analysis

Unlike technical analysis, which focuses on historical price data, fundamental analysis examines the underlying financial health and business prospects of a company. Fundamental analysts consider factors such as revenue, earnings, profit margins, and cash flow to assess the intrinsic value of a stock.

Fundamental analysis is often used to identify undervalued stocks that have the potential for long-term growth. However, it's important to remember that even fundamentally sound companies can experience short-term price fluctuations due to market sentiment or external factors.

Predictive Modeling

In recent years, predictive modeling has emerged as a powerful tool for price forecasting. These models use machine learning and artificial intelligence (AI) to analyze vast amounts of data and identify patterns that may not be visible to human analysts.

Predictive models can incorporate both historical price data and fundamental data to generate price forecasts. They can also be customized to account for specific factors, such as industry trends, economic conditions, and company-specific news events.

While predictive modeling holds great potential, it's important to use these models with caution. They are not perfect and can be susceptible to overfitting, where the model learns the training data too well and loses its ability to generalize to new data.

Selecting the Right Forecasting Model

The choice of which price forecasting model to use depends on a number of factors, including the investor's time horizon, risk tolerance, and investment goals. Here are some guidelines to consider:

- Short-term traders may find technical analysis more useful, as it can help identify potential trading opportunities and provide early warnings of reversals.

- Long-term investors may benefit more from fundamental analysis, as it can help identify undervalued stocks with strong growth potential.

- Investors with a high risk tolerance may want to consider using predictive modeling, as these models can potentially generate higher returns but also carry a higher risk of loss.

Price forecasting is an essential skill for investors who want to maximize their returns and minimize their risk. By understanding the different types of price forecasting models and how to select the right one for their needs, investors can gain a significant advantage in the stock market.

This guide has provided a comprehensive overview of price forecasting models for Strongbridge Bio Ord SBBP stock. By incorporating these techniques into your investment strategy, you can make more informed decisions and increase your chances of success in the financial markets.

**Image Alt Attribute:**

* **Strongbridge Bio Ord SBBP Stock Price Forecasting: A Chart Displaying Historical Price Data and Technical Indicators**

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Jaime MitchellEmpowering Teens: Dive into the World of Home Repair with "An Introduction to...

Jaime MitchellEmpowering Teens: Dive into the World of Home Repair with "An Introduction to... Jacques BellFollow ·6.1k

Jacques BellFollow ·6.1k Mario BenedettiFollow ·2.6k

Mario BenedettiFollow ·2.6k Trevor BellFollow ·10.7k

Trevor BellFollow ·10.7k Wesley ReedFollow ·13.8k

Wesley ReedFollow ·13.8k Virginia WoolfFollow ·5.2k

Virginia WoolfFollow ·5.2k Kirk HayesFollow ·16.5k

Kirk HayesFollow ·16.5k Larry ReedFollow ·17.6k

Larry ReedFollow ·17.6k Vernon BlairFollow ·5.5k

Vernon BlairFollow ·5.5k

Don Coleman

Don ColemanIn Search of Ramsden and Car: Unveiling the Unsung Heroes...

Document In the annals of scientific...

Tyler Nelson

Tyler NelsonThe Pyramid Home: A Journey Through Time and Architecture

Enter the Realm...

Lucas Reed

Lucas ReedThe Ultimate Guide to Brutal Chess Tactics for Beginners

Chess is a game of...

Brett Simmons

Brett SimmonsSurviving The Emotional Rollercoaster Of Separation

Every separation is a unique experience,...

Andy Cole

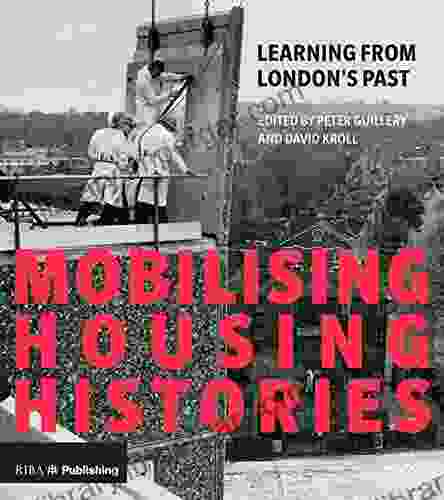

Andy ColeLearning From London's Past For A Sustainable Future

London is one of...