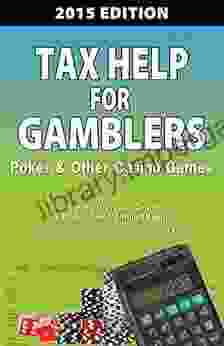

The Ultimate Guide to Filing Taxes for Gamblers: Poker, Casino Games, and More

Winning big at the poker table or casino is an exhilarating experience. But when it comes time to file your taxes, the excitement can quickly turn to confusion. Gambling winnings are considered taxable income, and the rules can be complex and vary depending on the type of gambling and the amount won.

This comprehensive guide will provide you with everything you need to know about filing taxes for gambling winnings, including:

4.6 out of 5

| Language | : | English |

| File size | : | 8693 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 167 pages |

| Lending | : | Enabled |

- What types of gambling winnings are taxable

- How to report gambling winnings on your tax return

- Deducting gambling losses

- Common tax mistakes to avoid

By following these guidelines, you can ensure that you are filing your taxes correctly and maximizing your deductions. Let's get started.

What Types of Gambling Winnings Are Taxable?

In the United States, all gambling winnings are considered taxable income. This includes winnings from:

- Poker

- Slot machines

- Blackjack

- Roulette

- Bingo

- Lottery

- Sports betting

The amount of tax you owe on your gambling winnings will depend on your tax bracket and the amount you win.

How to Report Gambling Winnings on Your Tax Return

You must report your gambling winnings on your federal income tax return. You can do this by using the following forms:

- Form 1040, Schedule A (Itemized Deductions)

- Form 1040, Schedule C (Profit or Loss from Business)

- Form 1040, Schedule SE (Self-Employment Tax)

Which form you use will depend on your individual circumstances. If you are not sure which form to use, you can consult with a tax professional.

Deducting Gambling Losses

You can deduct gambling losses up to the amount of your gambling winnings. This means that if you win $1,000 and lose $500, you can deduct $500 from your winnings on your tax return.

To deduct gambling losses, you must itemize your deductions on Schedule A. You can only deduct losses from gambling activities that are legal in your state. You must also keep a record of your winnings and losses. This can be done by using a gambling log or by keeping receipts from your gambling activities.

Common Tax Mistakes to Avoid

There are a few common tax mistakes that gamblers often make. These mistakes can lead to you paying more taxes than you owe. Here are a few things to avoid:

- Not reporting all of your gambling winnings. This is a common mistake that can lead to serious penalties. If you fail to report all of your gambling winnings, you could be subject to fines and even jail time.

- Deducting gambling losses that you did not incur. You can only deduct gambling losses up to the amount of your gambling winnings. If you deduct losses that you did not incur, you could be subject to penalties.

- Not keeping a record of your gambling winnings and losses. If you are audited by the IRS, you will need to be able to prove your winnings and losses. If you do not have a record of your gambling activities, you could be denied your deductions.

By following these guidelines, you can ensure that you are filing your taxes correctly and maximizing your deductions. If you have any questions, you can consult with a tax professional.

Filing taxes for gambling winnings can be a complex process. But by following these guidelines, you can ensure that you are filing your taxes correctly and maximizing your deductions. Remember, the key is to keep good records of your winnings and losses and to seek professional advice if you have any questions.

4.6 out of 5

| Language | : | English |

| File size | : | 8693 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 167 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Leo MitchellUnveiling the Mind-Body Connection: Exploring Psychobiology from a Biological...

Leo MitchellUnveiling the Mind-Body Connection: Exploring Psychobiology from a Biological...

Dylan HayesYour Complete Guide to Work From Home Jobs and Gigs: Unlock Flexible Earning...

Dylan HayesYour Complete Guide to Work From Home Jobs and Gigs: Unlock Flexible Earning... Jonathan FranzenFollow ·17.1k

Jonathan FranzenFollow ·17.1k Alex ReedFollow ·17.6k

Alex ReedFollow ·17.6k Hunter MitchellFollow ·11.9k

Hunter MitchellFollow ·11.9k Craig BlairFollow ·17.1k

Craig BlairFollow ·17.1k Dawson ReedFollow ·5.8k

Dawson ReedFollow ·5.8k Leo MitchellFollow ·8.1k

Leo MitchellFollow ·8.1k Colt SimmonsFollow ·5.1k

Colt SimmonsFollow ·5.1k Abe MitchellFollow ·13.9k

Abe MitchellFollow ·13.9k

Don Coleman

Don ColemanIn Search of Ramsden and Car: Unveiling the Unsung Heroes...

Document In the annals of scientific...

Tyler Nelson

Tyler NelsonThe Pyramid Home: A Journey Through Time and Architecture

Enter the Realm...

Lucas Reed

Lucas ReedThe Ultimate Guide to Brutal Chess Tactics for Beginners

Chess is a game of...

Brett Simmons

Brett SimmonsSurviving The Emotional Rollercoaster Of Separation

Every separation is a unique experience,...

Andy Cole

Andy ColeLearning From London's Past For A Sustainable Future

London is one of...

4.6 out of 5

| Language | : | English |

| File size | : | 8693 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 167 pages |

| Lending | : | Enabled |