To Learn Life Insurance: Maintain A Complex Life Insurance Portfolio

In today's uncertain world, securing the financial well-being of yourself and your loved ones is paramount. Life insurance stands as an invaluable tool to safeguard your loved ones against life's unexpected events and ensure their financial stability. However, navigating the intricacies of life insurance can be a daunting task.

Introducing "To Learn Life Insurance," a comprehensive and engaging guide written by industry experts to demystify the world of life insurance. This meticulously crafted book is designed to empower you with the knowledge and understanding you need to make informed decisions about your life insurance coverage.

Unveiling the Essential Elements of Life Insurance

Embark on a journey of discovery as "To Learn Life Insurance" meticulously unfolds the fundamental concepts of life insurance. From the types of policies and their benefits to the factors that influence coverage amounts and premiums, this book leaves no stone unturned in helping you grasp the intricacies of this essential financial tool.

5 out of 5

| Language | : | English |

| File size | : | 387 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 78 pages |

| Lending | : | Enabled |

Explore the Different Types of Life Insurance Policies:

- Term life insurance: Provides temporary coverage for a specific period, offering flexibility and affordability.

- Whole life insurance: Guarantees coverage for your entire life, accumulating cash value over time.

- Universal life insurance: Offers flexible coverage and premium payments, allowing you to tailor your policy to your changing needs.

- Variable life insurance: Links coverage to the performance of an investment portfolio, potentially providing higher returns but also introducing risk.

Understanding the Benefits of Life Insurance:

- Financial protection for loved ones: Ensures your family has the resources to cover expenses like funeral costs, mortgage payments, and education.

- Debt repayment: Protects against outstanding debts, preventing financial burdens from passing on to your beneficiaries.

- Wealth accumulation: Whole life policies accumulate cash value over time, providing an opportunity for savings and tax-deferred growth.

- Business continuity: Protects business owners and their families from financial losses in the event of a key person's death.

Mastering the Art of Policy Selection

"To Learn Life Insurance" provides invaluable guidance in selecting the right life insurance policy for your individual needs. Learn how to determine the appropriate coverage amount, identify the best type of policy, and compare different options to find the optimal solution for you.

Calculating Coverage Needs:

- Consider income replacement, expenses, and future goals to determine the appropriate amount of coverage.

- Utilize online calculators and consult with financial advisors to refine your calculations.

Comparing Life Insurance Providers:

- Research different insurance companies, their financial stability, and customer service ratings.

- Obtain multiple quotes to compare premiums and benefits.

- Seek professional advice to navigate the selection process and ensure you make an informed decision.

Navigating the Policy Riders and Endorsements

Unlock the power of policy riders and endorsements to customize your life insurance coverage and meet your unique needs. "To Learn Life Insurance" unravels the complexities of these additional features, empowering you to maximize the benefits of your policy.

Common Policy Riders:

- Waiver of premium rider: Waives premium payments in case of disability, providing peace of mind during challenging times.

- Accidental death benefit rider: Provides additional coverage in case of accidental death, offering enhanced protection.

- Child rider: Extends coverage to dependent children, providing essential financial support for their future.

Maximizing Your Beneficiary Designations

Ensure your life insurance benefits reach the intended recipients by understanding the intricacies of beneficiary designations. "To Learn Life Insurance" guides you through the process of naming beneficiaries, selecting primary and contingent beneficiaries, and updating your designations to reflect changes in circumstances.

Types of Beneficiaries:

- Individuals: Designate specific people, such as your spouse, children, or parents, as beneficiaries.

- Trusts: Name a trust as the beneficiary to manage the distribution of funds for specific purposes or to protect assets.

- Non-profit organizations: Donate a portion of your benefits to charitable organizations that align with your values.

Embrace the Power of Life Insurance

"To Learn Life Insurance" empowers you to make informed decisions about your life insurance coverage, ensuring the financial well-being of your loved ones. It is an indispensable resource for anyone seeking to navigate the world of life insurance with confidence.

Grab your copy today and embark on a transformative journey to secure your financial future and protect those you care about most.

5 out of 5

| Language | : | English |

| File size | : | 387 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 78 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

H.G. WellsKnowing, Protecting, and Enjoying the Self: Unlock Your Potential and Live a...

H.G. WellsKnowing, Protecting, and Enjoying the Self: Unlock Your Potential and Live a... Ricky BellFollow ·16.7k

Ricky BellFollow ·16.7k Brian BellFollow ·6.4k

Brian BellFollow ·6.4k Theo CoxFollow ·5k

Theo CoxFollow ·5k Franklin BellFollow ·7.6k

Franklin BellFollow ·7.6k Hassan CoxFollow ·19.9k

Hassan CoxFollow ·19.9k Stanley BellFollow ·17.8k

Stanley BellFollow ·17.8k Rex HayesFollow ·11.9k

Rex HayesFollow ·11.9k Lord ByronFollow ·6.7k

Lord ByronFollow ·6.7k

Don Coleman

Don ColemanIn Search of Ramsden and Car: Unveiling the Unsung Heroes...

Document In the annals of scientific...

Tyler Nelson

Tyler NelsonThe Pyramid Home: A Journey Through Time and Architecture

Enter the Realm...

Lucas Reed

Lucas ReedThe Ultimate Guide to Brutal Chess Tactics for Beginners

Chess is a game of...

Brett Simmons

Brett SimmonsSurviving The Emotional Rollercoaster Of Separation

Every separation is a unique experience,...

Andy Cole

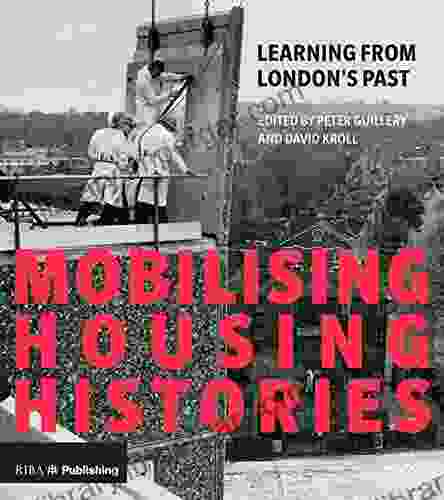

Andy ColeLearning From London's Past For A Sustainable Future

London is one of...

5 out of 5

| Language | : | English |

| File size | : | 387 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 78 pages |

| Lending | : | Enabled |