The Practitioner's Guide to Efficient Federal Tax Research Communication

5 out of 5

| Language | : | English |

| File size | : | 96976 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

Effective tax research communication is a critical skill for tax professionals. Whether you're communicating with clients, colleagues, or the IRS, your ability to clearly and concisely convey complex tax knowledge is essential.

This guide provides tax professionals with the tools and techniques they need to master the art of tax research communication. We'll cover everything from understanding your audience to writing effective tax research reports.

Understanding Your Audience

The first step to effective tax research communication is understanding your audience. Who are you communicating with? What is their level of tax knowledge? What are their goals?

Once you understand your audience, you can tailor your communication to meet their specific needs. For example, if you're communicating with a client who has little tax knowledge, you'll need to use plain language and avoid technical jargon.

Organizing Your Research

Once you understand your audience, you need to organize your research in a logical way. This will make it easier for you to write an effective tax research report.

There are a few different ways to organize your research. One common method is to use the IRAC method:

- Issue: What is the legal issue that you're researching?

- Rule: What is the relevant tax law or regulation?

- Analysis: How does the rule apply to the issue?

- Conclusion: What is your based on your research?

Another common method is to use the CREAC method:

- Claim: What is the main point of your research?

- Reasons: What are the reasons that support your claim?

- Evidence: What evidence do you have to support your reasons?

- Analysis: How does the evidence support your claim?

- Conclusion: What is your based on your research?

Which method you choose will depend on the specific research project that you're working on.

Writing Effective Tax Research Reports

Once you've organized your research, you need to write a tax research report. Your report should be clear, concise, and well-organized.

Here are a few tips for writing effective tax research reports:

- Start with a strong . Your should state the purpose of your report and provide a brief overview of your research.

- Organize your report logically. Use headings and subheadings to break up your report into manageable chunks.

- Use clear and concise language. Avoid technical jargon and use plain language that your audience can understand.

- Support your claims with evidence. Cite the relevant tax law and regulations to support your s.

- Proofread your report carefully. Make sure that your report is free of errors.

Communicating with the IRS

In addition to communicating with clients and colleagues, tax professionals may also need to communicate with the IRS. This can be a daunting task, but it's important to remember that the IRS is there to help you.

When communicating with the IRS, it's important to be professional and respectful. You should also be prepared to provide the IRS with clear and concise information.

Here are a few tips for communicating with the IRS:

- Be clear and concise. In your letters and communications to the IRS, you should be as clear and concise as possible.

- Provide the IRS with all necessary information. When you contact the IRS, make sure to provide them with all of the information that they need.

- Be patient. The IRS can sometimes be slow to respond to inquiries, but be patient and persistent.

Effective tax research communication is a critical skill for tax professionals. By following the tips in this guide, you can improve your communication skills and become a more effective tax professional.

5 out of 5

| Language | : | English |

| File size | : | 96976 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Adrien BlairUnveiling the Secrets of Ancient Cartography: A Journey to Accurate Global...

Adrien BlairUnveiling the Secrets of Ancient Cartography: A Journey to Accurate Global...

Heath PowellUnlock the Enigmatic World of Biblical Hebrew with Gesenius' Magnum Opus: A...

Heath PowellUnlock the Enigmatic World of Biblical Hebrew with Gesenius' Magnum Opus: A... Allen ParkerFollow ·15.8k

Allen ParkerFollow ·15.8k Gary ReedFollow ·14.7k

Gary ReedFollow ·14.7k Clayton HayesFollow ·9.9k

Clayton HayesFollow ·9.9k Enrique BlairFollow ·12.3k

Enrique BlairFollow ·12.3k Pete BlairFollow ·4.2k

Pete BlairFollow ·4.2k Shannon SimmonsFollow ·10.5k

Shannon SimmonsFollow ·10.5k Gerald ParkerFollow ·14.2k

Gerald ParkerFollow ·14.2k Cristian CoxFollow ·7.4k

Cristian CoxFollow ·7.4k

Don Coleman

Don ColemanIn Search of Ramsden and Car: Unveiling the Unsung Heroes...

Document In the annals of scientific...

Tyler Nelson

Tyler NelsonThe Pyramid Home: A Journey Through Time and Architecture

Enter the Realm...

Lucas Reed

Lucas ReedThe Ultimate Guide to Brutal Chess Tactics for Beginners

Chess is a game of...

Brett Simmons

Brett SimmonsSurviving The Emotional Rollercoaster Of Separation

Every separation is a unique experience,...

Andy Cole

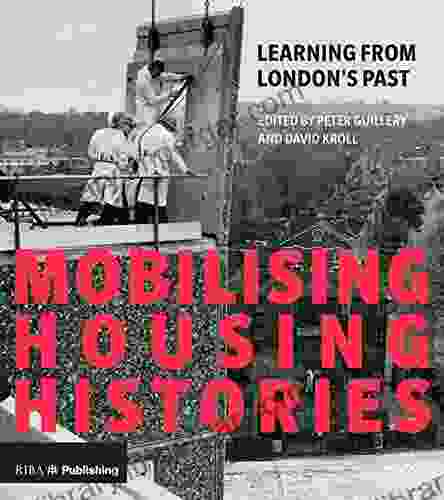

Andy ColeLearning From London's Past For A Sustainable Future

London is one of...

5 out of 5

| Language | : | English |

| File size | : | 96976 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |